Debt Consolidation: Comprehensive Knowledge You Just Have To Have

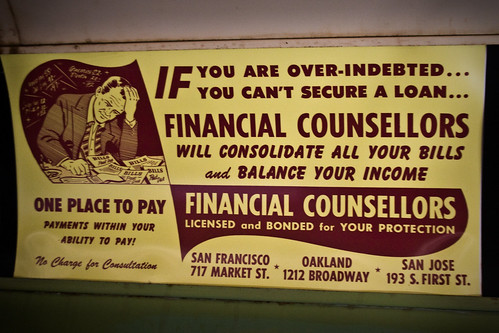

Posted at by PConran on category Debt ConsolidationWhen bills become overwhelming and a person can’t figure out how to get them all paid, a debt consolidation loan is sometimes the answer. Does this situation sound familiar to you? Is someone you know dealing with insurmountable debt? If so, you need to review the following information to learn more about debt consolidation.

Do not assume a non-profit company is your best bet when looking at debt consolidations companies. Scammers often find a way to get the non-profit label in order to trick unsuspecting people into bad loans. The BBB can help you find a reputable company or you can ask friends and family who are satisfied customers of their debt consolidation company.

Avoid choosing a debt consolidation company only because they are non-profit. For example, a company saying that it is a non-profit agency is not necessarily good. Check with the BBB to learn if the firm is really as great as they claim to be.

Do not borrow from a professional you know nothing about. Loan sharks are there to hurt people when they need help. If you want to take a consolidation loan, seek lenders with good reputations, offering fair interest rates.

Get a loan to repay debts, and then discuss settlement offers with your creditors. Most creditors will allow you to pay a lump sum of 70 percent of your balance. This doesn’t affect your credit in a negative way, and in fact, it can increase your score.

Try locating a consumer credit counselling business near where you live. Such an office can assist you in debt management and consolidation. If you choose them over the companies that charge for debt consolidation, it will look better on your credit report.

After your debt consolidation arrangement is in place, start learning to pay for everything in cash. If you don’t start using cash, you could find yourself in trouble again with even more credit problems. That could be what started your bad habit. With cash you make sure you don’t spend more than you can afford.

Find out if your debt consolidation offers individualized payment programs. A lot of companies do one standard plan, but that is not good because your budget may be different than other people’s. Locate a firm which offers payment plans which are personalized. You will end up spending less over the long haul even if the initial cost is higher.

If you are seeking the services of a company to help manage your debts, ensure that your are going with a reputable agency by doing a lot of research on them. Research the BBB website, as well as other watchdog groups, so that you can learn the companies you should avoid and which ones are good.

When speaking with a debt consolidation company, inquire about the fees. They should present you with a detailed fee structure for their services. They can’t collect anything if they don’t actually provide a service. Therefore, do not allow them to register you for one of their accounts, and don’t pay fees upfront.

Have you considered carefully the reason that you are in debt. Prior to taking out debt consolidation loans, you should know the answer to this. After all, if you are not aware of why you have gotten in this much debt, you will just fall right back into this hole in the future. Find the problem, stop it, and continue paying off the debts.

What fees come with your debt consolidator’s services? Every fee should have an explanation attached, and it should be written down in the contract. Make sure to ask how the loan will be divvied up between each of the creditors you have that need to be paid. You should receive a payment schedule detailing your payment dates and amounts.

Now you know how debt consolidation can give you a path to financial freedom. By using debt consolidation, it is possible to reduce your bills and get out of your debt for good. You should be able to improve your situation thanks to debt consolidation, and eventually pay your debt off.