The Most Important Debt Consolidation Information Around

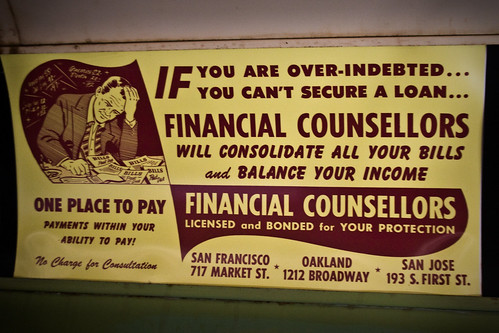

Posted at by PConran on category Debt ConsolidationIt’s an understatement to say that debt is harmful to our lives. However, just by going over this information you are helping yourself understand the process of debt consolidation which can eventually lead you to financial relief. Get a start with the following tips.

Consider your best long term options when choosing a company to consolidate your debts. Of course you want your immediate debts to be satisfied, but in the end. you want a company that can manage the entire process until you’re completely out of debt. Some can provide services that will help you stay away from this type of financial issue in the future.

A label of “non-profit” does not necessarily make for a great debt consolidation company. Being non-profit doesn’t mean that they are the best agency to help you with your needs. Check with the BBB to learn if the firm is really as great as they claim to be.

You can use your life insurance policy to get out of debt. If so, consider cashing in your policy and using the funds to pay down your debt. Your insurance agent should let you know how much money you’d be able to have against your policy. Sometimes you can pay off your debt with an amount borrowed from your policy investment.

If you get low interest credit card offers, you should consider using them for debt consolidation. You’ll save interest and have just one payment. Once you get your credit card balances all on one account, focus on paying it down before your introductory interest rate jacks up.

Find out more information about the interest rate for the debt consolidation. An interest rate that is fixed is the best option. This way you know the amount you will be paying for the duration of the loan. Beware of adjustable interest rate debt consolidation plans. You may even end up paying more in interest.

When assessing prospective debt consolidation companies, it is absolutely essential do your research and read a large number of consumer reviews of the specific firm. Use reviews written by clients to find a professional who is reliable enough to help you manage your finances.

Legitimate debt consolidators can help, but be sure they are indeed legit. If you feel like something is simply too good to be true, you may have fallen into a scam. Question the lender closely, and don’t proceed until you feel comfortable with the information you have received.

Look for a reliable credit counselor in your local area. These offices will help you organize your debt and combine your multiple accounts into a single payment. Using this service won’t affect your credit as badly as other debt consolidation services.

Debt causes major problems in people’s lives, from marital problems to health and psychological problems. There is a solution if you take the time to become educated about your options. Use the tips you just read and do more research on debt consolidation to make sure these strategies are adapted to your situation.