The Tips You Need In Regards To Debt Consolidation

Posted at by PConran on category Debt ConsolidationManaging debt is a very serious matter. It is hard to deal with debt, and you may need a bit of assistance along the way. You have to consider what debt consolidation offers you. The information here will teach you what you need to know.

Review your credit report before you decide on debt consolidation. The first step to taking care of your debt is understand how it began. Assess your debt and document how much you owe and who it is owed to. You cannot rebuild your finances if you aren’t aware of this.

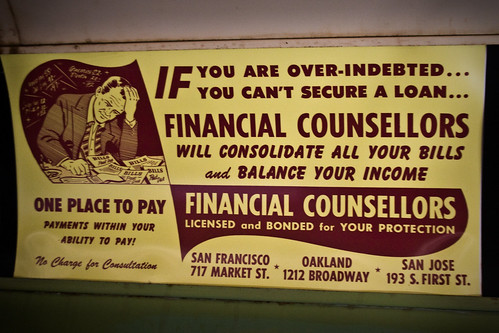

You must make sure the loan counselors at a company are certified and qualified. Are you going to be working with people who have an organization that certifies them? Is the company legitimate with the backing of well-known and highly reputable institutions? This can help make your decision easier.

Do you hold a life insurance policy? You might want to consider cashing in the policy so that you could pay your debts. Talk to your insurance agent for more information. You may be able to borrow a bit of what you’ve invested to help you pay your debts.

It may seem paradoxical, but borrowing money can help you reduce your debt. Talk to a bank or other lender in order to learn about the specific interest rates you may be eligible for. You may need to put up collateral, such as a car, to get the money you require. Make sure you pay your loan back on time.

Find out if bankruptcy is an option for you. Whether Chapter 13 or Chapter 7, it can be a bad mark for your credit. However, when you are already missing payments or unable to continue with payments, you may already have a worse looking credit report than a bankruptcy will be. Bankruptcy allows you to lower your debt and put you back on the path towards financial health.

Don’t borrow from just any lender. Loan sharks prey on your desperation. If you must borrow money, work with someone who has a strong reputation, offers a fair interest rate and has easily understandable repayment terms.

Legitimate debt consolidators can help, but be sure they are indeed legit. If you see offers that are simply too good to be true, then they probably are. Ask the lender a bunch of questions and be sure they’re answered prior to getting any kind of a contract signed.

You might consider drawing money out of your retirement fund or 401K to pay your high interest loans. This should be done only if you know you can pay the money back into your retirement fund. If you cannot pay the money back, you will have to cover taxes, penalties and will not have a retirement fund.

When you’re consolidating the debts you have, be sure you’re thinking about what debts you have that are worth getting consolidated and which ones shouldn’t be. If some debts have zero interest or an interest rate lower than your consolidation interest rate, you will want to keep them separate. Look at each loan individually to ensure you are making the best decision of whether to include it in your debt consolidation.

If you’re struggling financially, you’ll need to learn and understand how debt consolidation may be able to help you. Reading this article was a great starting point. Read as much as you can to acquire even more knowledge so you can begin to finally get on the path towards becoming debt free.