Everything You Should Know About Debt Consolidation

Posted at by PConran on category Debt ConsolidationCoping with your debt isn’t a joking matter. Sometimes you even need help. Therefore, you should think about turning to debt consolidation to help you. The tips from this article will help teach you what you need to know about debt consolidation.

Check out a credit report before seeking debt consolidation. You need to know how you got into debt. Find out what you owe and to whom. This helpful information will help you develop a debt consolidation plan adapted to your situation.

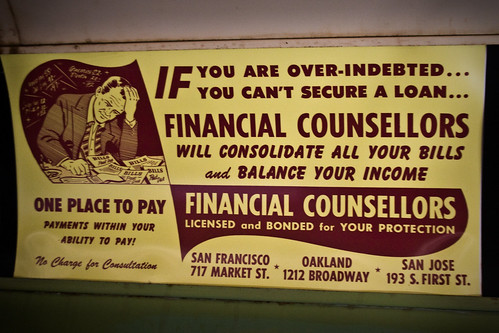

You must make sure the loan counselors at a company are certified and qualified. Is there any organization that has certified these counselors? Do they have a reputable institution backing them to prove legitimacy or strength. These are important factors when considering which debt consolidation company is the best one to help you manage your finances.

You may be able to pay off debt by getting another loan. Contact a loan provider to learn more about the interest rates you qualify for. You may be able to use a car or something a collateral for your loan and then use that money to pay off creditors. Be sure to pay it all back as expected.

People often find solutions to help pay off debt faster just by simply talking to creditors. Many creditors will modify payment terms to help a debtor who is in arrears. If you have credit cards and the monthly payments are too high, speak with the companies involved to negotiate a lower rate. Many times these companies are willing to work with you because they would rather get some money than lose it all.

Think about bankruptcy as an option. A Chapter 13 or 7 bankruptcy is going to leave a bad mark on your credit. If you cannot make your payments on time and are running out of options, filing for bankruptcy can be a smart move. Filing for bankruptcy lets you reduce debt and financially recover.

Obtain one loan that will pay all your creditors off; then, call the creditors to make settlement arrangements. You may by able to get a discount on how much you have to pay from your creditors. A lump sum settlement can increase your credit while lowering your overall debt.

Why is it that debt has taken over your life? You have to determine this before you take on a debt consolidation loan. You might end up in debt again if you do not improve your financial habits. Determine what the problem was, fix it, and move forward with paying your debts.

You need to know the physical address of the debt consolidation company. There are several states that don’t require credentials or licensing for people to begin a debt consolidation business. It is important that you don’t end up with one of these companies in a state that doesn’t regulate this industry. This information should be easy to find.

Stick to a budget. Whether or not a debt consolidation company offers to help you with one, a smart decision is to start really paying attention to how you spend your money. If you can learn how your money is being spent, you’ll be able to better manage your finances.

When you know who you need to pay, get the details of the debt. Be sure to provide all of the information such as monthly payments amounts, due dates, outstanding balances and how many creditors that you have. You need to have all your information gathered together so that you have a clear picture of everything during the debt consolidation process.

If you’re working on Chapter 13 bankruptcy you may be able to keep a hold on your real property with debt consolidation. By paying off debts within three to five years, you will likely be permitted to retain all property. You might even be able to have your interest removed from your debt.

If you want to try out debt consolidation, you should know as much as you can about it first. This article has helped you realize your first steps. Keep reading and learning all you can so you can finally crush your debt.