Become A Debt Consolidation Expert With These Tips

Posted at by PConran on category Debt ConsolidationIf you are too overwhelmed by your debt and always getting calls from companies, it can be a good idea to consolidate your debt. You can’t deal with your debt overnight, though. The process takes time and careful planning. The information that follows should help you make good choices when you’re considering consolidation.

Get a copy of your credit report before embarking on the debt consolidation journey. Try identifying which financial practices caused you to end up in debt. You need to know your debtor and the amount you owe. You can only fix your problem if you know these things.

Never go with a debt consolidation company just because they claim non-profit status. Though it may surprise you, non-profit is not necessarily indicative of quality. Check the company out with the BBB first.

A simple way to take care of debts is to borrow money. Talk to multiple financial institutions about what interest rates you could expect to pay. Use your vehicle if the loan provider asks for a collateral so you can borrow enough to cover your debt. It’s important to pay back your loan when it’s due.

You might want to think about refinancing your house loan and using this cash to pay off your debts. With mortgage rates at their lowest, this is a good time to refinance and take care of your other loans. Often your mortgage payment can be lower, compared to what it used to be.

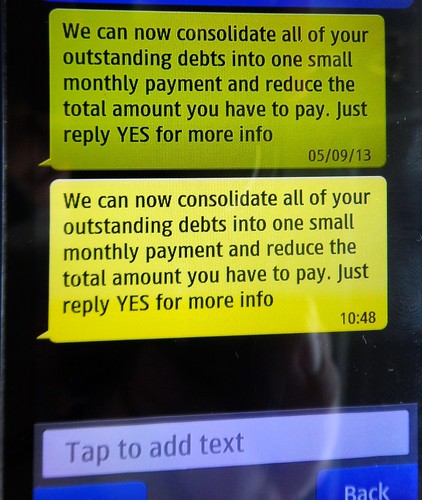

Debt consolidation offers financial assistance, but you must avoid scams. Keep in mind that if things seem too good to be true, they probably are. Write down your list of questions, and always make sure that you walk away satisfied with the answers to avoid getting scammed.

Looking into non-profit consumer credit counseling. These offices can help you manage your debt and merge all your accounts into one. Using a debt consolidation counselor may hurt your credit score, but going through your local consumer credit counselor will have less of a negative impact.

If the plan is to go with a debt consolidation service, do research first. If the people you work with aren’t interested in your financial situation and don’t ask questions on how you see yourself getting out of debt, then immediately look for another company. Reputable debt counselors work with you and come up with a personalized plan.

Can you personalize your payment plan at your debt consolidator? You cannot use a one-size plan that is applied to all debtors. Look for a debt consolidation agency with personalized solutions. Although these may appear more expensive in the beginning, they actually will save you money in the long run.

Fill out the documents you receive from the debt consolidation company properly. Your careful attention is very important. If you make errors yourself, this can delay or mess up the process, so make sure you are filling things out correctly.

Using debt consolidation to help get your finances in order could be very helpful if you understand how it works. You cannot simply get on the phone and start talking unless you acquire some knowledge first. The tips from this article will help you navigate through debt consolidation.