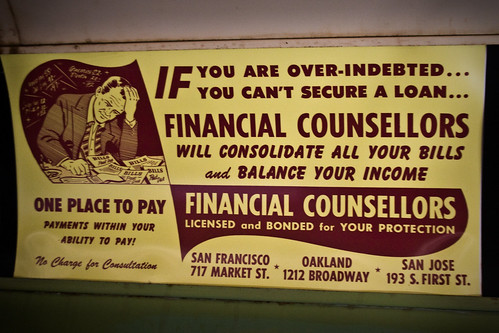

Easy Debt Consolidation Strategies You Can’t Go On Without

Posted at by PConran on category Debt ConsolidationWhat do you think of debt consolidation? Learning more on this topic will help you make the right decision and perhaps get out of debt quickly. The opportunity it provides is fantastic relief for most people, but you need to know exactly what you are getting yourself into. All companies are not the same. Continue reading to learn more about the important facts that will help you to make a good financial decision.

Never go with a debt consolidation company just because they claim non-profit status. Contrary to what you may believe, “non-profit” does not always equate to great. A good way to verify the reputation of a business is to consult with the BBB.

Are you on life insurance? Cashing in your policy will allow you to get out of debt. You must talk with your insurance company to see what you can receive against the policy you hold. Sometimes you’re able to borrow just a little of what you’re investing into the policy so you can pay off your debt.

You can get rid of debt by borrowing money. Speak with a loan originator to see if there is something you can get with lower interest rates to help you pay down your debt. Your vehicle can be used sometimes as collateral as well, and of course the money you can can pay off your creditors as a whole. Do not delay in payment as this can result in more interest.

When you’re trying to get a debt consolidation loan, find out where you can get a fixed rate that’s low. If the rate is variable, you will never know how much the total loan will cost you until the end. Look for for a loan that gives favorable terms in the long run and will leave you in a better financial state once it is paid off.

Consider applying for a low interest credit card in order to consolidate debts. You will be able to save on interest and will then only have to make a single payment. Whenever your debts have been consolidated on a single card, you can then focus on paying this debt off prior to the expiration of this interest offer.

Ask about your debt consolidation company’s interest rate. A fixed rate of interest is usually your best option. This helps you know what is to be paid throughout the life of your loan. Watch out for any debt consolidation program with adjustable rates. Frequently, you end up making more interest payments than what you had originally expected.

Looking into non-profit consumer credit counseling. These organizations offer valuable debt management and consolidation services. This won’t hurt your FICA score as significantly as other methods might.

If you have a 401-K, you can use it to reduce your debts. This allows you to borrow money from yourself instead of turning to a traditional bank for a consolidation loan. Just remember that taking money from your retirement funds can be a risky action, so make sure you explore the pros and cons before choosing this option.

Negotiate your debt during the debt consolidation process, before you agree to anything. Call up your credit card firm and ask them if they can give you an interest rate which is fixed if you cancel the card itself. You may be surprised at what you will be offered.

Ask about their privacy policy. It is important that you are aware of how they store your private information. Ask whether encrypted files are used. If not, you could find your identity stolen.

When considering debt consolidation, make sure that you check out the reputations of a few different companies. Visit BBB.org to find out which firms are the best choice.

Learn the physical location of your debt consolidation service. Some states actually have no laws or licensing in place for a new company when they start up. It is important that you don’t end up with one of these companies in a state that doesn’t regulate this industry. It’s easy to learn this information.

You are now prepared to go ahead and get moving towards the right plan for debt consolidation. All you need to do is consider your personal situation. Do not be overwhelmed by the money you owe. Instead, receive the right help today by joining forces with a debt consolidation company.