Create A Smart Debt Consolidation Plan With These Tips

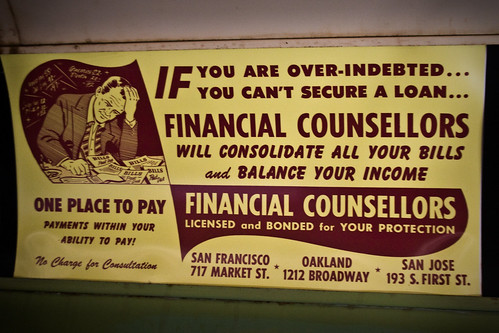

Posted at by PConran on category Debt ConsolidationWhat do you know about debt consolidation? Maybe you have lots of debt with various interest rates and things are out of control. Debt consolidation may be the answer. Read on and gather valuable information about the many ways debt consolidation can be of help to you.

Consider the long term when picking out the debt consolidation business that’ll be helping you. Obviously, you want to get the current situation straightened out, but find out whether or not the company will work with you in the future as well. They may be able to help you avoid debt in the months and years to come as well.

Think about filing for bankruptcy. Bankruptcy does negatively affect your credit. However, if you are missing payments and unable to pay off your debt, your credit may already be bad. You can decrease debts and work towards financial comfort when you file for bankruptcy.

You might want to think about refinancing your house loan and using this cash to pay off your debts. Since mortgage rates are showing historical lows, this could be a great solution. Also, you may find mortgage rates to be lower.

Debt consolidation can be the help that you are looking for if they are not a scam. If something appears too good to be true, then it is most likely exactly that. Write down your list of questions, and always make sure that you walk away satisfied with the answers to avoid getting scammed.

Looking into non-profit consumer credit counseling. A credit counselor will help manage your debt by putting all accounts into one account. Using a consumer credit counseling service will not hurt your credit score as much as going through other professionals who offer debt consolidation services.

You shouldn’t consider debt consolidation as a temporary measure for your debt. Debt is always going to be a problem for you if you do not change your ways. Look for changes you can make in your finances to improve them in the future.

If you are in a bind and quickly need to pay down your debt, look at your 401k plan to help with debt consolidation. This lets you borrow from your own money instead of an expensive bank. Make sure you do have all the details before borrowing, and know that it is a risky venture as it can take away your retirement funds.

You can use what is called a snowball tactic to pay down your debt. Pick your highest interest rate card, and pay it down as fast as you can. Use the savings from that missing payment to pay down the card with the next highest rate. This option is better than most.

How did you end up so deep in debt? You need to think about this before signing a loan for debt consolidation. If the cause is not addressed, the symptoms will surely reappear. If you can put an end to the problem, you can end your debt situation.

Can you contact the consolidation company anytime you need something? Even if you already have an agreement, there may be some things you need to have answered. Ensure this company has an excellent customer service center who will always answer any questions or concerns you have.

Now that you’ve gone over everything you needed to know, you can tell if you need to use the advice or not. Will debt consolidation help you out? Create your plan carefully and put it into action. The time has come to live again!