Want Answers For Your Debt Consolidation Problems? We Have Them

Posted at by PConran on category Debt ConsolidationIf you’re in deep debt and getting harassed with phone calls from creditors, debt consolidation can be a sigh of relief. However, do not expect this plan to have an instant, positive effect. It takes time for it to work. The process is lengthily and requires planning. The following article offers many great tips if you’re thinking about going the debt consolidation route.

You should first get a copies of all of your credit reports because they may contain inconsistencies and errors. You have to know why you are in this position to start with. This can help keep you making good financial decisions.

When choosing your debt consolidation company, look at the big picture. You want work done now, but will they company be there in the future? Many offer services that can help you today, tomorrow and well into the future.

Do you hold a life insurance policy? Many life insurance policies allow you to cash in your policy. Find out just how much money you will be able to receive against your policy. Sometimes you can pay off your debt with an amount borrowed from your policy investment.

It may seem paradoxical, but borrowing money can help you reduce your debt. Speak with loan providers to help get the wheels in motion and determine the interest rate you might qualify for. You may need to put up collateral, such as a car, to get the money you require. It’s important to pay back your loan when it’s due.

When you go into a debt consolidation program, you need to understand how you got into financial problems and how to avoid them in the future. Knowing what started it will help you avoid it happening again. Figure out how this situation came to be so you don’t have to deal with it again.

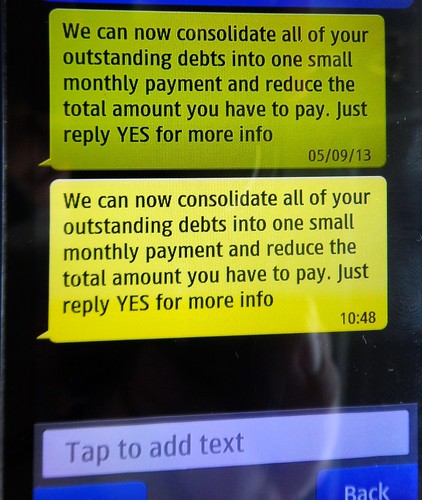

Some debt consolidation agencies aren’t on the up and up. An offer that looks good on the outside may be filled with hidden fees and charges. Make sure to ask tons of questions of your lender and get answers prior to entering into any agreements.

You might be able to remove some money from your retirement fund to help you get your high-interest credit cards paid off. Do this only if you are confident that the money can quickly be replaced. If you can’t replace the funds, you’ll have to pay a penalty and a tax.

See if the folks who work at the debt consolidation company hold counselor certifications. You’ll find companies that you can trust through the NFCC – the National Foundation for Credit Counselors. This way you can be sure you are working with a legitimate company.

When you get a good debt consolidation plan going, make sure you then start paying for things in cash. You do not want to build up more debt! These things may be what caused your large debt. When you pay only in cash, you can’t possibly overspend.

As an alternative to debt consolidation, think about using a “snowball” tactic to determine the order you pay off your debts. Start with your highest interest credit card and concentrate on paying it off quickly. Then, start paying off the next debt; adding to it the money you would have used for the previously paid debt. It’s one of the best choices you can make.

If you approach debt consolidation strategically, it really can help. Making a phone call isn’t all that it takes to get out of debt. The article you have just read has provided you with some excellent strategies to resolve your debt. However, you must be the one to make the decision to implement them and do it.