Personal Finance Tips That Can Work For Anyone

Posted at by PConran on category Personal FinanceIf you are single, your money management skills may not affect anyone other than yourself. However, if you are the head of your household, you have an added incentive to do the right thing. By reading this article, you will learn helpful tips that will enable you to manage your personal finances better.

Never sell unless circumstances suggest it is wise. If you are earning a decent amount of money on a stock, let it sit for a while. Try to look what stock you have and move them around to better suit you.

You should write down every penny you spend to find where you are blowing the most money. If you put it away then you may completely forget about it. A better option is to track expenses on a large whiteboard that sits out in full view. By doing this, you’ll probably see the board much more often, which will ensure it remains on your mind all day.

Avoid the large fees that some brokers charge. There are fees associated with long term investment brokers. These fees can end up cutting into your overall profits. Steer clear of brokers who charge exorbitant commissions for their services or pile on lots of account management charges.

If you desire a favorable credit score, use two, three or four credit cards. Only using one card at a time makes it difficult to build up a solid credit score; however, using a greater number of cards than four makes it difficult for you to efficiently manage your finances. Start with two cards and build your credit by adding new cards when needed.

Help manage your personal finances with a good insurance policy. Everybody is going to get sick sometimes. For this reason, it is vital to have good health insurance. It doesn’t take long for medical bills to add up, and even a minor health problem can be very costly. That can leave an enormous hole in the pocket if you are without insurance.

If collectors are harrassing you for repayment of debts, try and do some negotiating with them. They probably bought your debt off for a very low price. You could end up only paying a fraction of your debt. Use this knowledge to your advantage to avoid paying debts in full.

Credit Card

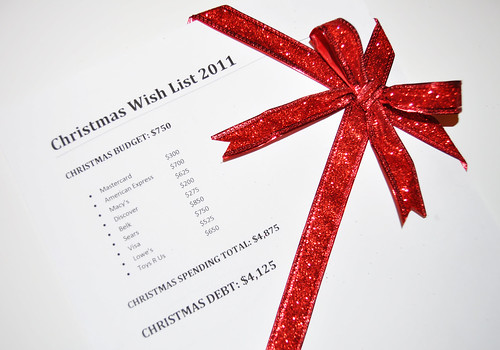

The best way to avoid messing up your personal finances with dangerous credit card debt, is to stay out of the hole in the first place. Before you decide to use a credit card, think very carefully. Ask yourself how long it will take to pay off. Unless it’s an essential item, don’t buy more on credit than you can afford to pay off at the end of the month.

Always have money in your savings account in case of an emergency. You can save for a specific goal that you have in mind, like paying off credit card debt or saving for college.

You can sell an old laptop if you’re trying to earn a little extra money this month. Operational machines or easily fixable ones can bring better prices than broken machines. You can still get a little money for a laptop that doesn’t work.

Nobody is perfect, particularly when it comes to managing personal finances. If you bounce a check once, you may be able to request that the fee is waived by your bank. This is usually a one-time courtesy that banks extend to good customers.

As we said before, personal finances are very important for people with families. Having a budget is essential to help you limit the number of things you buy each month.

Related Posts to Personal Finance Tips That Can Work For Anyone

Warning: strncmp() expects parameter 1 to be string, object given in /home/fidezo5/public_html/Financeandcash.com/wp-content/themes/wp7in1/resize.php on line 73

Warning: strpos() expects parameter 1 to be string, object given in /home/fidezo5/public_html/Financeandcash.com/wp-content/themes/wp7in1/resize.php on line 82

Catchable fatal error: Object of class WP_Error could not be converted to string in /home/fidezo5/public_html/Financeandcash.com/wp-content/themes/wp7in1/resize.php on line 85